We want to know only “peak and bottom” of Wave but not side show of “differ with circumstance and to know only where the loss cut or profit cut is, but not panacea of all excuse.And want to be all naked prices through the Cassandra diary.And want to be convinced ourselves that tomorrow price cannot be the random theory like drunken man working but orders from disorder Bon Voyage!

Saturday, December 21, 2013

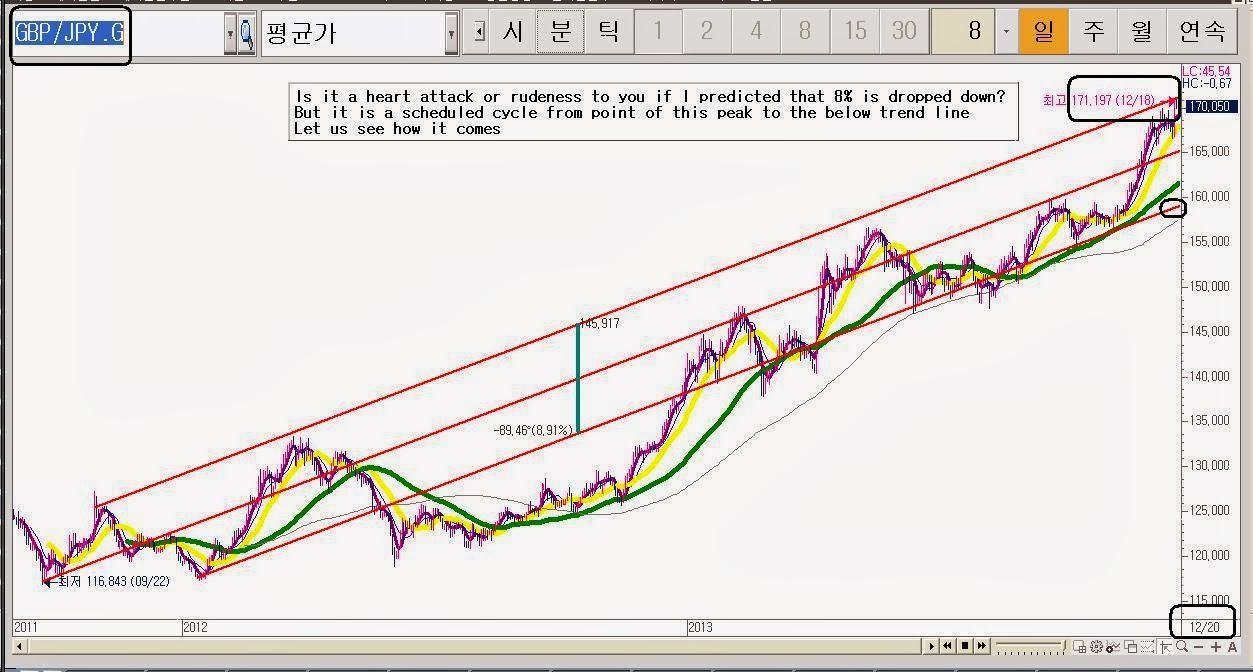

if it is rebounded after 8% reduction of Great British Pound (GBP) against Japanese Yen (GBP/JPY)

I hope you not to be distress too much from

the Cassandra words, if it is rebounded after 8% reduction of Great British

Pound (GBP) against Japanese Yen (GBP/JPY).

It cost down not only (GBP/JPY) but also its

relative items such as: EUR/JPY and USD/JPY

Friday, August 9, 2013

Today I would like to talk about USD/JPY with macro vie

Today I would like to talk about USD/JPY with

macro view

This is a long term view of it in Monthly

chart

It may be useful information for major players

rather than individual players.

Perhaps a year later you may see it what Cassandra

chart had been said.

Somehow

Briefly I diagnose it with my favorite signals

information

See below!

①

Is bullish trend line of

monthly chart but it is breakthroughs by ②

and ⑦ of down line of BBS with “V” signal

②

Is collective trend line signified

for 3 month with 3 candles. but you may be query how much it is going to be

adjusted? The answer are ③(Fibonacci adjustment) and ④( 12ma

of middle line of Bollinger bands)

③

Is Fibonacci line. We can judge with

it what strengthen of Wave will happened since it is totally depended on ratio

of it. for example

④

Is 50% of Fibonacci overlapped by

red color line of BBS middle line? If the ratio of adjustment are less than 50%

of it. you should correspond with Box theory if it is more than 50%, you may

ensure this wave is not dead and powerful. hence as time goes by let us watch

out the movement of candle whether if the candle is resisted by the red line or

not, Especially when the stochastic gold signal just like ⑥

⑤

Is stochastic (5.3.3), which we

wait for just like ⑥ (gold single)

⑥

Is stochastic triple bottom

At any rate if you are short term trader,

take a position in down trend line. Because with daily chart, it is triple top.

Furthermore if you are interested in when

it is turning into bullish phase again, please wait for the single of Double

tops after whether the previous low line (94.232) is breakthrough or not.

Monday, July 15, 2013

technique for handling “Symmetrical convergence”

Do not stingy about review and compare what

I told you yesterday

It is the result from what we expected

Eventually it is happened to the long blue

candle

And is lesson for “come down on the right

side of the fence”

I wish you to remember this technique for handling “Symmetrical

convergence”

Bog Voyage !

yours Cassandra

Friday, July 12, 2013

Let us diagnose 30 minute candle chart and make “the plan B” of EUR/USD,

This is for EUR/USD, 30 minute candle chart

Let us diagnose 30 minute candle chart and

make “the plan B”

It is decisively timing whether we go for

or pass it

If we can see long red or blue candle on

the verge of when the market is opening, Monday in Korean time, 06:35, we can

obtain the profit for it and for it’s providence

Check it out whether it is happened one of

both candle and “come down on the right side of the fence” because of below

information:

①

Is of triangle

②

Is the vertex of triangle with convergence

③

Is previous low point which we

can look open it as one of resistance line

④

Is Fibonacci adjustment which

we may judge it for upward since the rate of adjustment is above of 50%

⑤

Is red color candle what we

wish for

⑥

Is blue color candle what we which

for since this game is able to both direction

Therefor

It is totally relay upon Monday opening

price candle.

I wish you to have good luck and nice time

Yours Cassandra

Friday, July 5, 2013

About USD/JPY.

Of USD/JPY.

It is 30min Chart.

See the ①② and recognize that it is 120 ma and 240ma(moving average)

And fully comply with the trend line ③ without any rebellion

As you noticed, no sooner had the Mas

converged into the trend line ③ than the candles was up as likely

as rocket

However

For the readers of long terms investor, I would

like to advise you to keep going on it and companying with trend but to alert the

previous higher point, 103.405Yan.

If the 103.405Yan is breakout as a new

record, the Wave is not dead

Sunday, May 12, 2013

Friday, April 26, 2013

Shall we trace what happen to USD/JPY since March 8?

You may be a

mushroom millionaire if you keep it

Think about the

meaning of “Breakthrough the previous higher point”

I will be back

according with a fat wallet

Good luck

Your Odyssey Lee

Anyone a

mushroom millionaire has become?

I don’t think so

Few investors can

get profit from this usual opportunity lest they should be truly chart professional

list.

Tomorrow is too late

to study for analyzing the chart language

Today do it what

chart is twitting, ingratiating and insinuating to you

However

The above

article had been written March 8

Today it is May

30, 2013

① Is the price of march 8

(94.872 Y)

② Is the highest price of its

duration

③ Is price 98.038 Y of today

may 26

④ Is the gap 5.10% between march 8 (94.872 Y) and its peak

point 99.800

5% is not so much profit

to be enough a mushroom millionaire but

you may realize the power of chart language

Bong voyage!

Your Odyssey

Monday, March 11, 2013

Compare the result with Cassandra words of EUR/CAD

Compare the result with Cassandra words

The Cassandra has predicted about EUR/CAD

Let us review what she said and what is

wrong about her words

①

Is the level of bottom what she

was talking about 1.33506$

②

Is real happened to the peak

③

Is what she predicted

The price is reached at the level of 1.39%

between 1.33506$ and 1.35380$

The difference is 0.35% between 1.35380$

and 1.35892$ which is error of Cassandra

It will be good for you to know who is she

?

Friday, March 8, 2013

USD/JPY: You may be a mushroom millionaire if you keep it

Do not be fretting from any news but go for

your way and only your way

You may be a mushroom millionaire if you

keep it

Think about the meaning of “Breakthrough

the previous higher point”

I will be back according with a fat wallet

Good luck

Your Odyssey Lee

Thursday, March 7, 2013

The result of EUR/CAD

What is going on our plan for days swing terms?

3 days ago I posted (2013/03/04 21:03) about the deal between 1.33515 and 1.35489

And promised you that I will come back!

It is reached at the point of 1.78% within 4 days?

Indeed it is huge gap

you get the profit about 1.14% if you listen to me (prepare carefully with posted and with chart time )

What can we do now?

Wait for original price or ensure profit now?

I would like you to wait for the our original plan which is preordained by profit 1.78%

good luck

Your Odyssey Lee

한국어 사용자 보세요

3일전에 올렸던 글에 대한

결과치입니다.

과연 예측치에 도달 했나요?

아직은 100% 그 값에 오지 않았지만

80% 가격에 왔지요

매우 큰 이익 되였을 것입니다.

이쯤에서 너무 좋아라 기뻐하지 마시고

처음에 우리가 계획했던 가격까지 묻들고 가세요

성투하세요

Monday, March 4, 2013

EUR/CAD for 3 days terms

Could you be patient until it is touched on

price of 1.33515?

And deal it with a week term. I mean that you

have to wait for the price 1.35489

It is profited gap about 1.78% for swing

terms

make it sure that you must buy it between the gap price

I wish you good luck

To Korean speaker

유로와 케나디안 달러 입니다.

차트처럼 제가 마크를 그린 법위안에서 거래를 하세요

1.33515에서 구입하고 1.35489에서 매도 하는 전략을 취하셔야 합니다.

약 1.78% 수익을 목표로 하세요

Tuesday, February 19, 2013

What if the 5MA is side-way movement after 1 ~ 2days later?

This is Daily

chart of GBP/CHF.

I would like to

give you a question

What if the 5MA is side-way movement after 1 ~ 2 days later?

①

Is stochastic seeming C wave

②

Is before

candle of 6days

③

Is before candle of 5days

④

Is today candle

⑤

Is 5ma

Do you think today’s MA is turning up after

1~2 days if the price is side-way?

Monday, February 11, 2013

Sunday, February 10, 2013

About GBP/CHF you have to switch the stance owing to TREND.

Sorry!

I have been lazy about this game

We celebrate New Year festival in the lunar

calendar.

Happy new years

About GBP/CHF you have to switch the stance

owing to TREND.

The trend has been switched you must obey

it

But when?

It is question for us

Let us wait until it take a course of

retracement

I think it is too much rebounded

Please try to best to do shot the bottom of

adjustment

actual fluctuated (92.177~94075) USD/JP she said (91,314~93,820)

Do you remember what Cassandra Said ?

It will be Fluctuated between (91,314~93,820) Yen (2.22%)

of a week

however

How much has it been difference from her before and

after?

How much has it actually been fluctuated?

Let us checkup?

It has been actually fluctuated (92.177~94075) USD/JPY

But she said (91,314~93,820) USD/JPY

Can you notice the difference for weekly prediction?

A little bit error is forgivable, if we are talking about

big wave such as weekly prediction

It might be more precisely predicted if she is asked such

as daily or hour’s one

Anyway

I would like to warn you that the TREND should be shaded

way since we have been enjoy it too much

About this week prediction of fluctuation I would like to

be silence because it is confronted with meaningful point which is 91,314

Yen.USD/JPY

According to this pivotal point I wish you to make plan

for weekly project and wish you to remember the Wave theory of TREND

Bon voyage

Written in Sunday, February 10, 2013

Odyssey Lee

Wednesday, February 6, 2013

Cassandra said yesterday

Cassandra said yesterday “It is a long lane

that has no turning” or “The ebb and flow”

Was it a peak in shorter view of trading?

Cheer up!

====

Reminders!

It is real time live show

I wish you to check it posted Korean and chart time

And wish you to review from oldest posted Chart because it is reversely list up.

Thanks

Yours Odyssey Lee

Tuesday, February 5, 2013

It is the after of Cassandra USD/JPY

Do you remember Before of Cassandra?

it will be Fluctuated between (91,314~93,820) Yen (2.22%) of a week

Here

it is the after of Cassandra USD/JPY

it has been reached at 94.040 which is a little bit higher than she calculated

I think it is allowable due to Weekly Prediction

Hence you have to prepare to ensure the profit

cut since we agree with “there are lane

with no curve”

Let us see the chart about posted time and reported time

What is actually happened to GBP/CHF?

Let us compare Cassandra words “before and

after”

What is actually happened to GBP/CHF?

Has she six senses for prediction?

How did she know about rebounded point of it?

And calculated that is meant to be touched on

the previous higher point?

This is chart world

Let us see it

This is a probe of Chart in live chart

Please check the posted time of Blog and Korean

time

Be hold!

Don’t waste your all energy to know the Bloomberg

News nor economic and political situation

The real trading has nothing to do with the

neither rhetoric nor ornament, But to do with peak and valley of the Wave.

Do not listen to any news but watch out the

Chart, only the chart tell you when you must buy and when you must sell

What else you can do with such news and dazing

talk?

Forget all about economic report but close

to The Chart.

Cassandra

Monday, February 4, 2013

Sunday, February 3, 2013

Can it be touched upon 1,43422 of previous higher point?

Can it be touched upon 1,43422 of previous higher

point?

Yes

I should be at least rebounded up to 1,43422

however

please compare the items of USD/JPY

then I think you can come to it

this information never be useful for long terms view trader

but scalpers

because it is 30 minute chart of Wave inflection

Do not be shy to tell me what time frame chart you want to know

it is totally up to time frame chart regardless of methodology

the skill is the same but only time frame chart is different

it means

if you can predict 30 minute chart

you must predict daily weekly monthly chart even millennium chart

just give me any chart I will tell you according as time frame

however

please compare the items of USD/JPY

then I think you can come to it

this information never be useful for long terms view trader

but scalpers

because it is 30 minute chart of Wave inflection

Do not be shy to tell me what time frame chart you want to know

it is totally up to time frame chart regardless of methodology

the skill is the same but only time frame chart is different

it means

if you can predict 30 minute chart

you must predict daily weekly monthly chart even millennium chart

just give me any chart I will tell you according as time frame

it will be Fluctuated between (91,314~93,820) Yen (2.22%) of a week

As I mentioned before “issue and making a

sense” there are two things.

One is obvious of UPTREDN of USD/JPY

The other one is “issue and making a sense”

against the obvious one

Obey the obvious things do not play with “issue

and making a sense” Unless you are Cassandra

I wish you not to follow Cassandra words instead

of keeping going on “UPTREND”

Nevertheless Cassandra wants to be a freak

and geek

For it is attracting people’s attention because

it is interesting

Here is “the issue and making a sense” of inflection

of a week

She said that it will be Fluctuated between

(91,314~93,820) Yen

Let us see a week later again whether if

she can be enough to be a freak and geek or not

Bog voyage

Friday, February 1, 2013

Comply and Enjoy with the trend.

I would like to post those items USD/JPY and

GBP/CHF

No sooner have been opened the Forex market

than I will analysis the range of fluctuation for weeks

By the way

What is The Issue or make a sense?

When The Issue or making a sense has

something about no meaningless, It should have some meaning for issue or making

a sense

When something is too obvious to mention it,

we may be no interesting for it is no more issue and sense

For example

In chart language, Cassandra and I have been

interesting in “The INFLECTION of wave” not because all men know but because anyone

can hardly know it

We have believed that we can be snatched

from all attention from unique idea against usual things such as “USD/JPY and GBP/CHF”

for a month

As you know Cassandra chart prediction, she

has make the issue and sense, to tell you

When the chart is uptrend she mentioned inflection

of downtrend

When the chart is downtrend she mentioned

inflection of uptrend because we have believed that it is make a sense for the

issue

It means you have to respect the main TREND

but you can play with inflection if you

know.

know.

For example USD/JPY is uptrend; you must

not stance against it.

In the same way GBP/CHF is downtrend you

must not say against it, because it is power of Trend

When every Gill and Jack know it, of course,

even Dog and mouse know Power of Trend

It is useless for talking about it because

it is any longer Issue and topic

Comply and Enjoy with the trend.

Nothing can be profitable from Technical anlysist

than TREND

Be Hold!

The USD/JPY is uptrend, enjoy the trend

The GBP/CHF is down trend enjoy the trend

If you want to be a freak you can tease the

chart with inflection like Cassandra

If you not, obey with its TREND

Let us see the USD/JPY

If you obey the TREND perhaps you have

earned less money than Cassandra who would tease the inflection of Wave But

know that it is most difficult to know inflection of wave

Your police is simple as this

“Just ignore the inflection and comply with

trend after compromising with your greed”

And then the fear will not visit you “as

rust eat iron, so care eats the heart”

In same way GBP/CHF

Just comply with it’ TREND

Yours Odyssey Lee

What is The Issue or make a sense?

I would like to post those items USD/JPY and

GBP/CHF

No sooner have been opened the Forex market

than I will analysis the range of fluctuation for weeks

By the way

What is The Issue or make a sense?

When The Issue or making a sense has

something about no meaningless, It should have some meaning for issue or making

a sense

When something is too obvious to mention it,

we may be no interesting for it is no more issue and sense

For example

In chart language, Cassandra and I have been

interesting in “The INFLECTION of wave” not because all men know but because anyone

can hardly know it

We have believed that we can be snatched

from all attention from unique idea against usual things such as “USD/JPY and GBP/CHF”

for a month

As you know Cassandra chart prediction, she

has make the issue and sense, to tell you

When the chart is uptrend she mentioned inflection

of downtrend

When the chart is downtrend she mentioned

inflection of uptrend because we have believed that it is make a sense for the

issue

It means you have to respect the main TREND

but you can play with inflection if you know.

For example USD/JPY is uptrend; you must

not stance against it.

In the same way GBP/CHF is downtrend you

must not say against it, because it is power of Trend

When every Gill and Jack know it, of course,

even Dog and mouse know Power of Trend

It is useless for talking about it because

it is any longer Issue and topic

Comply and Enjoy with the trend.

Nothing can be profitable from Technical analysis than TREND

Be Hold!

The USD/JPY is uptrend, enjoy the trend

The GBP/CHF is down trend enjoy the trend

If you want to be a freak you can tease the

chart with inflection like Cassandra

If you not, obey with its TREND

Let us see the USD/JPY

If you obey the TREND perhaps you have

earned less money than Cassandra who would tease the inflection of Wave But

know that it is most difficult to know inflection of wave

Your police is simple as this

“Just ignore the inflection and comply with

trend after compromising with your greed”

And then the fear will not visit you “as

rust eat iron, so care eats the heart”

In same way GBP/CHF

Meanwhile I am afraid of misunderstanding

what I told you

It does not mean “take a Selling position” at

the verge of opening market Monday

For scalpers do not sell it because it will

be rebound as inflection

But for the day traders you must obey the

TREND

Yours Odyssey Lee

Subscribe to:

Comments (Atom)