We want to know only “peak and bottom” of Wave but not side show of “differ with circumstance and to know only where the loss cut or profit cut is, but not panacea of all excuse.And want to be all naked prices through the Cassandra diary.And want to be convinced ourselves that tomorrow price cannot be the random theory like drunken man working but orders from disorder Bon Voyage!

Saturday, December 21, 2013

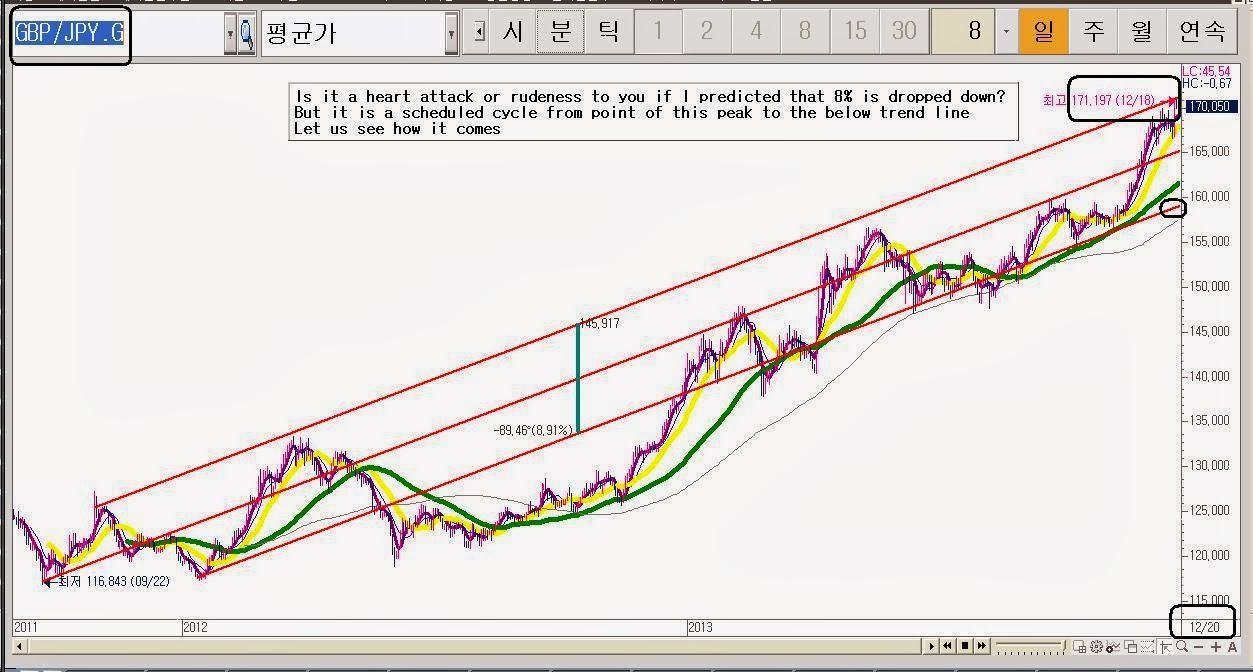

if it is rebounded after 8% reduction of Great British Pound (GBP) against Japanese Yen (GBP/JPY)

I hope you not to be distress too much from

the Cassandra words, if it is rebounded after 8% reduction of Great British

Pound (GBP) against Japanese Yen (GBP/JPY).

It cost down not only (GBP/JPY) but also its

relative items such as: EUR/JPY and USD/JPY

Friday, August 9, 2013

Today I would like to talk about USD/JPY with macro vie

Today I would like to talk about USD/JPY with

macro view

This is a long term view of it in Monthly

chart

It may be useful information for major players

rather than individual players.

Perhaps a year later you may see it what Cassandra

chart had been said.

Somehow

Briefly I diagnose it with my favorite signals

information

See below!

①

Is bullish trend line of

monthly chart but it is breakthroughs by ②

and ⑦ of down line of BBS with “V” signal

②

Is collective trend line signified

for 3 month with 3 candles. but you may be query how much it is going to be

adjusted? The answer are ③(Fibonacci adjustment) and ④( 12ma

of middle line of Bollinger bands)

③

Is Fibonacci line. We can judge with

it what strengthen of Wave will happened since it is totally depended on ratio

of it. for example

④

Is 50% of Fibonacci overlapped by

red color line of BBS middle line? If the ratio of adjustment are less than 50%

of it. you should correspond with Box theory if it is more than 50%, you may

ensure this wave is not dead and powerful. hence as time goes by let us watch

out the movement of candle whether if the candle is resisted by the red line or

not, Especially when the stochastic gold signal just like ⑥

⑤

Is stochastic (5.3.3), which we

wait for just like ⑥ (gold single)

⑥

Is stochastic triple bottom

At any rate if you are short term trader,

take a position in down trend line. Because with daily chart, it is triple top.

Furthermore if you are interested in when

it is turning into bullish phase again, please wait for the single of Double

tops after whether the previous low line (94.232) is breakthrough or not.

Subscribe to:

Posts (Atom)