About usefulness

of technical analysis and its reliability(GBP/AUD.)

I am infrequently web’s browsing for

world stock and Forex market

Whenever I see main topic and issue

of tomorrow price, I would deeply depress people’s idea for mis-handling these

matters

Especially approaching mythology of fundamental

analysis not only stock market but also Forex (foreign exchange) market)

And I frequently and automatically resent

the peoples who are leading wrong side of this matter. yes it is wrong,totally

I feel like it is even unpardonable

sin if someone insists wrong way for us to go, for our life is limited and confined with certain period life time not to be wasted.

nevertheless myriad dealers seems to disagree with

me that they have been wasted time and life, lingering in fundamental mythology

of it

even read out all the newspaper and all online information of it.

I know

it is not easy to comprehend since all the language is not easy if you agree

that chart is language

though it is one of hardest language. it is very convenience

tool that you can be unshackled from the uncontrollable immense of data of public

My dear readers:

Behold!

Never approach our issue from the fundamental analysis but totally ignore it

and be friend with technical analysis

(if you

agree with me that we have a certain period life time)

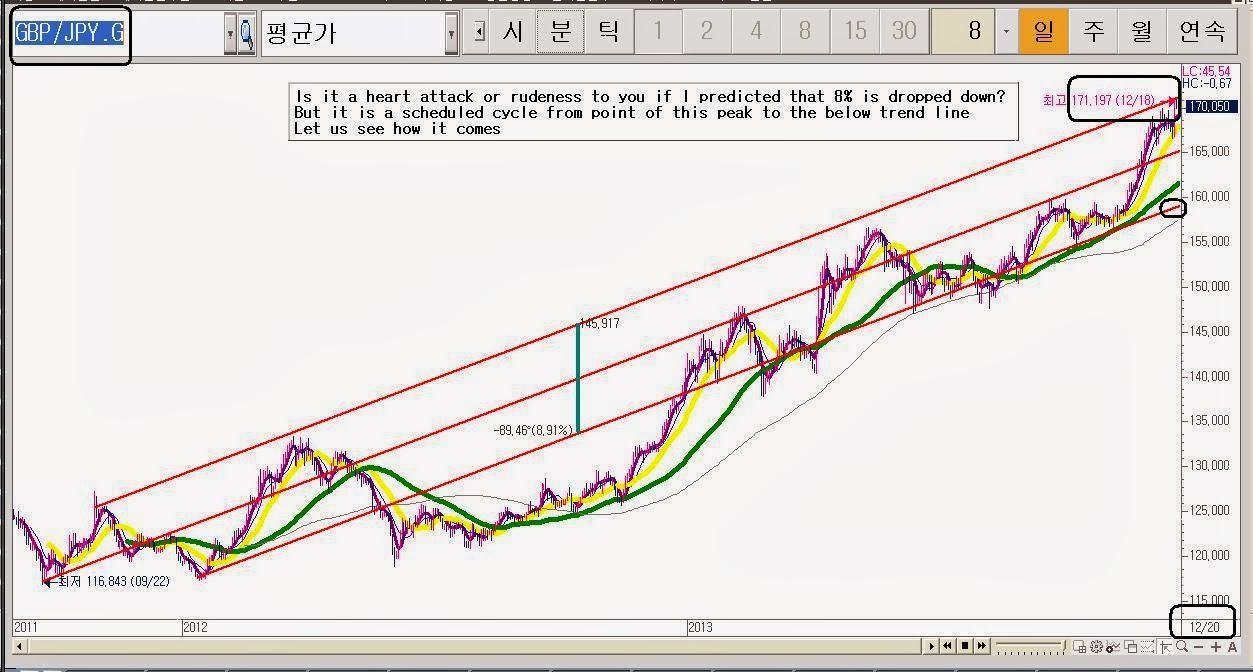

This will be good example why we should keep away from it

but be friend with technical analysis

For example

I would like explain for Great

British Pound (GBP/AUD.) how it goes for profitable works

====

If it is correct what I advised, I wish

you to be join with me and trust it. and cheer up

If it is not correct let us turn away

from it

However

it is not only example but also profitable information

and will be big fortune if you have

and keep it for years

Since it is speak out its future

trace of fatalism of gravity of chart.

=====

What processes it will be taken in

terms of long, middle and short terms period view.

I hope it will be useful each

diverged investors for time sensation.

also

I hope it will not be misinterpreted,

disregarding of the size of wave’ displacement (so called it is the relative

value of time frame)

Otherwise it can’t be misunderstand

of my interpretation ( in same way you can apply it for 5 minute chart, if you are a scalper )

Finally I hope you to truly and

carefully check out my credibility and reliability throughout my past record

written on my personal Blog that have been posted for years both English and Korean

speakers in such items Forex, international index (Dow Jons) commodity oil and

gold price etc. and compare what is really happened to “before and after”

I hope it is not meaningless time for

you, scrutinizing all the my past record whether if it is correct or

insignificant

of just dazzling incomprehensible chart language or not

1. Monthly chart Monthly chart (GBP/AUD.G)

for long terms view

2. Weekly chart (GBP/AUD.) for middle

terms view

3. Daily chart (GBP/AUD.) for short

terms view

Let us hear what chart is saying from 3

years to 3 weeks story of GBP against AUD

It will be preordained by the sequence

of a big wave and small wave orderly

Hence it is started with monthly

chart to see the big wave first.

1. Monthly chart

Monthly chart (GBP/AUD.G) for long terms view

①

is 10ma(moving average)

you may see that it is supported. It means it is very strong trend for upward movement

②

is stochastic index which

is my favorite and is precede movement of 5ma when it is golden cross

③

is breakout for 5 months

candles and breakout the it’s trend line

In whole chart view, it is breakthrough

down trend line. We are about to turn to point of uptrend in the displacement

of monthly chart

2. Weekly chart

(GBP/AUD.) for middle terms view

Let us zoom in/out the those 8 monthly

candles

We may see the more detail story of

it

①

is stochastic shown by divergence

of 5ma

②

is another stochastic shown

by superposition of 10ma

③

is shown by under ripe of golden

cross of 20ma but it is showing that the gold cross will be soon happened if it

is true of sequenced process

④

is previous high point 1.81985

which is breakthrough from the rectangle black box. Hence we may apply box theory

from now on

⑤

is the weekly candle stick

out from box.

in order to see the more detail story

inside of black rectangle behind story, let us ask the daily chart , enlarging of those part.

3. Daily

chart (GBP/AUD.) for short terms view

①

is stochastic shown triple

bottoms of precede of 5ma

②

is 10ma of stochastic 2 times

ratio of 5ma stochastic of course it is precede signal of movement of 10ma

③

is down trend line showing

is a pattern of triangle or wedge pattern which means that big players strategically

accumulated of it

④

is derailed from down

trend and start uptrend statically and is shown also today’s closed price 1,83203

( today it is July.4.2014)

⑤

is showing the date which

will be accorded with posting date of my blog.

From now on, review

and compare the entire chart, monthly, weekly and daily chart.

You may notice

the discord with weakly chart’s box theory and with daily chart triangle

pattern.

It is tiny difference of box theory and triangle. But main issue is whether

if trend lines are breakthrough or not. In my eyes it is obvious the trend line

is breakout which means that it is starting point of uptrend.

To the my

readers

It is wave’s

size of daily chart. if you want to know tomorrow price of it, you have to see

30 minute chart even more small size of wave and its displacement, you may use

5 minute candle chart.

Remember it

is not for 1 minute or hour price of it, rather it is for 3 weeks and 3 month

even for 3 year traders

Hence

if you have

intention of dealing with such a time frame, buy and hold it now tomorrow and

ignore it since “A watched pot never boils”

Furthermore it

will be good reference for long terms investors

I wish those

investors to visit from time to time my blog for checking it’s fatalism of GBP/AUD

I have often been asked “what is yours strategic” “tell me few sentence”

Many fellows think chart skill is transformable from a brain to a brain and is comprehensible enough but it nature is not such a thing rather it is only attribution of man obtain from experience which you should felt in your born

That is one of reason why an expert expose their methodology, to the public, due to knowing that it is hardest language which listeners can not be obtainable

Including me, many experts will never tell you their power and secret, specially our era of selfish and individualism

let us say in this way :

If there are two ways, what are you going

to select one of both?

1) The easiest way is telling to the public

How to earn the money?

2) the most difficult way to himself

How to earn the money

Indeed!

They do not know the methodology!

If they know,

they will not bother themselves to teach

you the technical trading after paying Advertisement, and so on.

They do know it

They will click the keyboard inside of toilet

secretly without knowing you

Behold

And be a wiser

Do not trust their humanity that they are

restless to make you millionaire instead of themselves

There is no such a thing in the world,

fretting or paying them to open the methodology

of trading.

Do not waste time and life but Build your

world by yourself!

Bon voyage!

Yours odyssey lee